DPA 14 Lender Resources

The Mississippi Home Corporation in conjunction with the Board of Supervisors from Coahoma, Tunica, and Washington counties are able to assist borrowers with homeownership by offering a competitive mortgage rate through the proceeds of the sale of Mortgage Revenue Bonds. Total assistance of $14,000 to borrowers with upfront costs associated with their mortgage purchase. This program will end April 30, 2026.

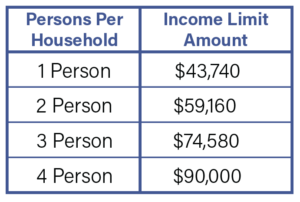

Income Limits

*5 or more persons in the household cannot exceed the MRB7 income limit amount

MRB Acquisition Limits

Target - 332,000

FAQs

- Is the additional $7,000 non-repayable? It is forgiven after 12/31/2026

- Will there be a lien? Yes, the additional funds take 3rd

- How will MHC fund the additional assistance at closing? it will be wired to closing.

- Will the program forms be generated from the portal upon MHC approval? Yes, all forms will be on our reservation site.

- Will the new DPA funds be provided by MHC at closing? Or are the funds coming from the actual county? The loan will run as normal through our system. It will be considered a MRB7 reservation and the lender will still close and fund the first and second in the lending institution’s name. The additional $7,000 from the county will be wired to closing.

- If a Borrower is interested in this new option and qualifies, do they reserve these new funds in the MHC online portal, or will they need to apply through the County? The lender will reserve the funds and everything will come through the MHC reservation system as normal.

- How long will the program last? The program will expire on April 30, 2026, or when funds are depleted, whichever comes first.

- Is the 3rd lien subject to TRID (require an LE and CD disclosure)? There will not be a TRID/Loan Estimate and Closing Disclosure on the 3rd lien due 0% interest.

- Are there any allowable fees on the 3rd lien? The only fee we see is the recording fee.

Program Bulletins/Notices

MHC Lender Notice - Underwriting Turnaround Time (5/9/2024)

MHC Press Release - DPA14 Program Launch (2/12/2024)

MHC Lender Notice (7/12/2023)