Mortgage Credit Certificate (MCC)

The Mortgage Credit Certificate (MCC) reduces the amount of federal income tax the borrower must pay, which in turn, frees up income to qualify for a mortgage. Homebuyers must not exceed household income and home purchase price limits set according to federal tax law and MHC guidelines.

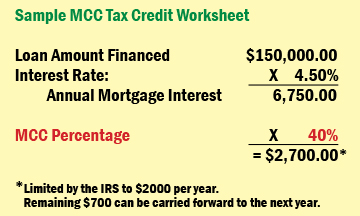

The federal government allows every homebuyer to claim an itemized federal income tax deduction for all of the mortgage interest paid each year on a mortgage loan. The MCC will allow the borrower to take a tax credit equal to 40% of the annual interest paid on the mortgage loan. That is a dollar-for-dollar reduction of their federal tax liability. The remainder (60%) of the mortgage interest will continue to qualify as an itemized tax deduction. The specific dollar amount of the tax credit depends on how much interest the borrower pays on a mortgage loan. The amount of the credit cannot be more than their annual federal income tax liability after all other credits and deductions have been taken into account. In no case can the tax credit exceed $2,000 per year.

To receive an immediate benefit from the MCC, the borrower must file a revised W-4 withholding form with their employer, which should reduce their yearly tax contribution and increase the borrower’s take-home pay, or take the benefit once a year through the federal income tax return to be filed.

Features of the MCC Program:

- Lender follows guidelines depending upon which type of loan is utilized

- Can be used with Fannie Mae or Freddie Mac conventional, fixed-rate, adjustable rate, FHA, VA, and RD financing.

- May be combined with MHC’s Smart6 program at 30-year fixed rate.

- Can be used as a stand-alone product with 15, 20, 25, or 30-year term

Who is eligible:

- First-time homebuyers or persons who have not owned a principal interest in a residence in the past 3 years

- Certain areas of the state, called “Target Areas”, are exempt from the “first-time homebuyer” rule

- Maximum annual income of household members may not exceed certain income limits

Program Requirements:

- Property must be owner-occupied

- Property must be primary residence

- Must be a single family residence

- Manufactured home must be HUD approved

- Borrower must own or purchase land on which the manufactured home will be sited

- Cost of home must be within maximum acquisition cost limits for county in which property is located

- Borrower must have available the following:

- $300 non-refundable reservation fee to participate in the program

- Sales contract including a legal description of the property

- Federal Income Tax returns for the past three years, and any other documents required by the lender

- Homebuyer education certificate showing completion of classroom or online course